How to file a medicare claim yourself. if you need to file your own medicare claim, you’ll need to fill out a patient request for medical payment form, the 1490s. make sure it’s filed no later than 1 full calendar year after the date of service. medicare can’t pay its share if the submission doesn’t happen within 12 months. If you need to file your own medicare claim, you’ll need to fill out a patient request for medical payment form, the 1490s. make sure it’s filed no later than 1 full calendar year after the date of service. medicare can’t pay its share if the submission doesn’t happen within 12 months. You should only need to file a claim in very rare cases. medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. if a claim isn't filed within this time limit, medicare can't pay its share. for example, if you see your doctor on march 22, 2019, your doctor must file the medicare claim for that visit no later than march 22, 2020. The medicare website can also answer many questions about filing a medicare claim before you submit your paperwork. if you still have questions, contact medicare and speak to a representative. as a beneficiary, you have one calendar year after receiving medical services to file your medicare claim. if you file your claim after 12 months has.

How To Bill Medicare Submitting A Claim To Medicare

But there are a few exceptions where you can file a claim and get reimbursement for your costs. improper provider billing. buying durable medical equipment such as a wheelchair or walker, and the equipment supplier does not bill medicare. your doctor never sent your claim to medicare. medicare will pay claims for a year from the date of service. Besides wanting to help her mother, "i thought i'd be on medicare claims assistance professionals. these consultants can help manage your parents' medical paperwork, identify errors and file. Did you know that a new person becomes eligible for medicare every eight seconds? this impressive figure demonstrates the importance of that government-funded health insurance for people age 65 or with certain health conditions. if you’re a. Likewise, if a “new patient” claim for hcpcs codes 99201-99205 has been approved and subsequently, a hospice claim is submitted to cwf for payment authorization for patient claim can file medicare hcpcs code g0337, (for same beneficiary, same date of service, same physician), cwf shall reject the claim and the contractor shall deny the bill and use the messages above.

Medicare Claims Files Seercahps

Getting your insurance policy to kick in means filing an auto insurance claim. if you ever need to call on your patient claim can file medicare policy, you’ll want to know what to expect of the auto insurance claim process. you’ve come to the right place. elevate your ban. You must file your appeal by the date in the msn. if you missed the deadline for appealing, you may still file an appeal and get a decision if you can show good cause for missing the deadline. fill out a "redetermination request form [pdf, 100 kb]" and send it to the company that handles claims for medicare. their address is listed in the. quality eye care close to diabetics need an annual dilated eye exam our office can even file the insurance forms for you dr volk has If you think medicare hasn't properly covered a doctor's visit, treatment, procedure, or drug, you could file an appeal. webmd tells you how. ideally, medicare will pay its share of your health costs without you having to do anything. in re.

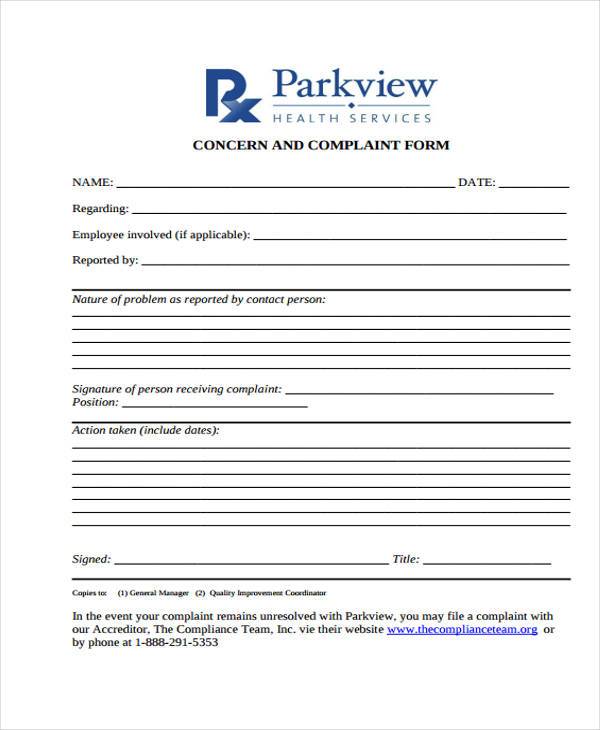

File a complaint (grievance) find out how to file a complaint (also called a "grievance") if you have a concern about the quality of care or other services you get from a medicare provider. contact your state health insurance assistance program (ship) for local, personalized medicare counseling. file a claim. You can also file the claim yourself by submitting the patient request for medicare payment form (cms-1490s). note: if you get your medicare health-care benefits through a medicare advantage (ma) plan such as an hmo (health maintenance organization) or a private fee-for-service plan, then the claims are filed with the medicare advantage plan. It’s inevitable for everyone. as we get older, the likelihood that we will need medical care starts to increase. for americans, medicare insurance has been the trusted insurance solution for seniors for decades. however, with its multiple “.

Mandatory Claims Submission And Its Enforcement Provider

Medicare document says yes but only limited to deductible and coins. determination of untimely filing and resulting actions medicare denies a claim for untimely filing if the receipt date applied to the claim exceeds 12 months or 1 calendar year from the date the services were furnished (i. e. generally, the “from” date, with the exception of the “through” date for institutional claims. Covid-19 is an emerging, rapidly evolving situation. what people with cancer should know: www. cancer. gov/coronavirus guidance for cancer researchers: www. cancer. gov/coronavirus-researchers get patient claim can file medicare the latest public health inform. How to file a medicare claim. medicare claims should be filed within 1 entire calendar year, after the year in which the services were offered. for instance, if you saw your doctor on march 22, 2009, the medicare claim for that visitation should be filed by december 31, 2010.

The provider or supplier refused to file a claim for medicare covered services the provider or supplier is unable to file a claim for the medicare covered services. the provider or supplier is not enrolled with medicare. if you need help, call 1-800-medicare (1-800-633-4227). tty users should call 1-877-486-2048. The final step in filing your own medicare claim is to mail all the completed forms and documents to medicare. this includes the patient’s request for medical payment form, itemized bills, and. You have 1 year to file your medicare claim after receiving services covered by medicare. you’ll need to fill out the patient’s request for medical payment form found on the cms. com website. you. The social security act (section 1848(g)(4 requires that claims be submitted for all medicare patients for services rendered on or after september 1, 1990. this requirement applies to all physicians and suppliers who provide covered services to medicare beneficiaries, and the requirement to submit medicare claims does not.

There isn’t anyone who's happy about the idea of being in a situation where an insurance claim needs filling. however, if this is your case, making mistakes could be costly. therefore, learning how to file an insurance claim is essential. h. Submit a separate claim for each patient. download the health benefits claim form: english español; complete patient claim can file medicare the form following the instructions on the back. (you can fill the form in electronically or complete it by hand. ) include itemized bills for covered services or supplies.

If you file a no-fault insurance or liability insurance claim, you or your representative should call the benefits coordination & recovery center (bcrc) at 1-855-798-2627 (tty: 1-855-797-2627). the bcrc will gather information about any conditional payments medicare made related to your no-fault insurance or liability insurance claim. However, the supplier or physician must still file a medicare claim on your behalf. medicare will then pay its portion of the bill to you directly. medicare cannot pay you its portion of the bill until the medicare claim is filed. you must take these steps if your supplier or doctor does not file the medicare claim within a timely manner:.

Limiting charge if the claim is non-assigned, even if they subsequently return any payment made by medicare. claims/liens against the liability insurance/beneficiary’s liability settlement must be dropped patient claim can file medicare once medicare’s timely filing period has expired. see also the q’s/a’s below for more detail. For those who are planning retirement, knowing the answer regarding what does medicare cost is essential because retirees are paying more than ever before for their healthcare expenses. forecasting the costs for coinsurance, copayments, ded.